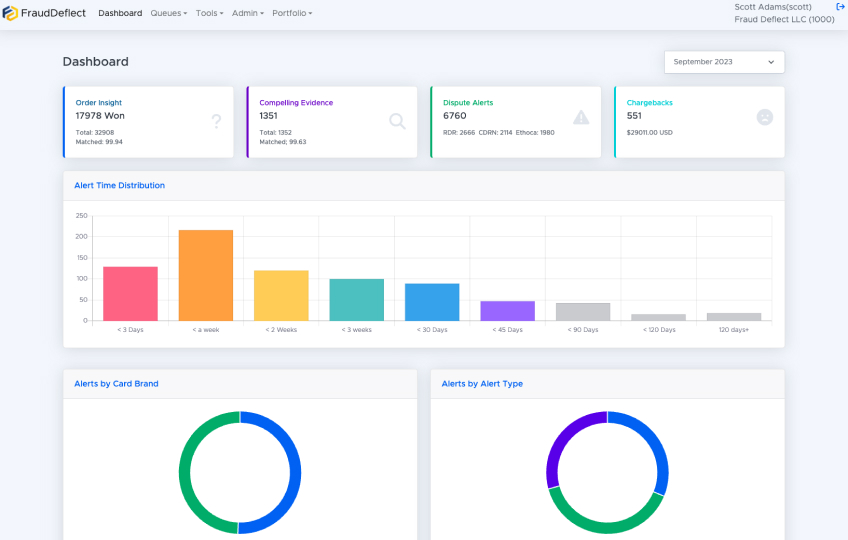

Chargebacks and Alerts are meaningless without great data analysis to go with it. Our team and systems constantly analyze and keep an eye on your traffic so we can make sure to maintain industry leading results.

FraudDeflect make it simple, and with little to no integration, to share transaction data with Issuers during their customer support calls... right when the card holder is most likely asking for a chargeback. We have a high success rate of preventing the chargeback before it even becomes an alert ... thus saving your sale!

All of this without any merchant engineering lift in most cases. Since we connect to CRMs and Gateways we often do not need the merchant to do anything. If we do we offer easy to use sFTP, AWS S3 and Rest API options that are way simpler than the other providers.

FraudDeflect is fully integrated and partners with all alert providers so that we can receive any available alerts and stop your chargebacks before the card brands are notified. This prevents you from being on any of the monitoring lists and saves you chargeback fees.

In the event that everything else misses, we still can represent, which we do 'by hand', since there is no substitute for the human ability to tell the story to connect with the person reviewing the chargeback and show them why you, the merchant, is in the right. We also take full advantage of the regulations like Visa Compelling Evidence and other rules that limit your chargeback liability.

Our belief is that Chargeback Representment is mostly going away and automation via the services we're seeing come out lately is the future. In case those don't work for some transactions or others slip through the holes in these systems, we do represent chargebacks for our merchants.