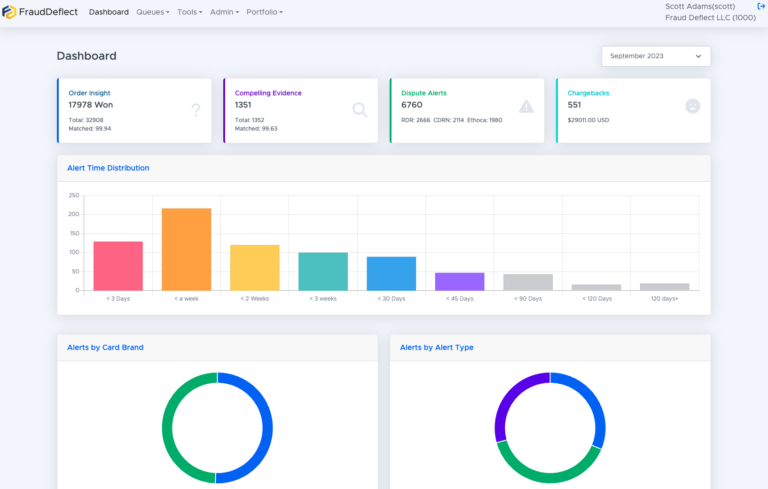

Our system analyzes your inquiry, alert and dispute traffic continuously looking for ways to optimize to help you lower chargebacks and save money. We catch Duplicate Alerts, Alerts/RDR that turn into chargebacks, and other anomalies so you don't have to.

FraudDeflect makes it simple to share transaction data with Issuers during their customer support calls. We support Visa Compelling Evidence 3.0, Ethoca Consumer Clarity, Verifi Order Insight, and soon Mastercard First Party Trust.

FraudDeflect stops your chargebacks before the card brands are notified. We support Verifi CDRN, Ethoca - Confirmed Fraud, Verifi Rapid DIspute Resolution (RDR), Ethoca - Customer Disputes plus Verifi Inform.

We still can represent, which we do 'by hand', since there is no substitute for the human ability to tell the story to connect with the person reviewing the chargeback. We also take full advantage of the regulations like Visa Compelling Evidence 3.0 and other rules that limit your chargeback liability.

We aim to be the EVOLUTION of Friendly Fraud and Chargeback Management bringing Trust, Integrity and Transparency to an industry that too often uses ‘tricks of the trade’ and is shrouded in mystery.

The disruption, the uncertainty, the potential closure.That’s why we do more than just manage chargebacks. We actively work to fix these problems so that you don’t have to worry about having our merchant account terminated and focus, instead on growing your business.

What distinguishes Fraud Deflect from the rest is our ability to beyond providing solutions. We are a partner in progress, keen on sharing success with our clients.

In essence, Fraud Deflect is more than just a vendor; we are a reliable partnercommitted to protect digital commerce, ensuring security, and promoting mutual success.